- GenAI Foundry

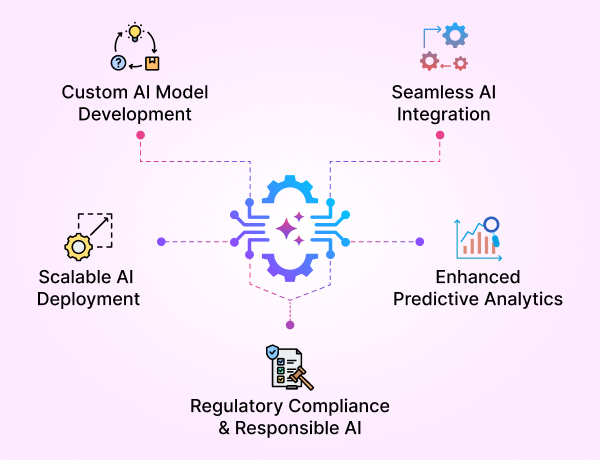

GenAI Foundry

The enterprise GenAI platform for full control over your model, data, and intelligence — tailored for regulated industries.

Build, Fine-Tune & Deploy Private GenAI Models Securely

- InsurancGPT

AI Purpose-Built for the Insurance Industry

InsurancGPT

Custom-tuned suite of LLMs trained on deep insurance domain data including P&C, Auto, Health, and Life

The Core Intelligence Engine for Insurance AI

- NammaKannadaGPT

NammaKannadaGPT

Foundational Large Language models for native languages

- ROI Calculator

ROI Calculator

Transforming Business Efficiency with the Enkefalos ROI Calculator

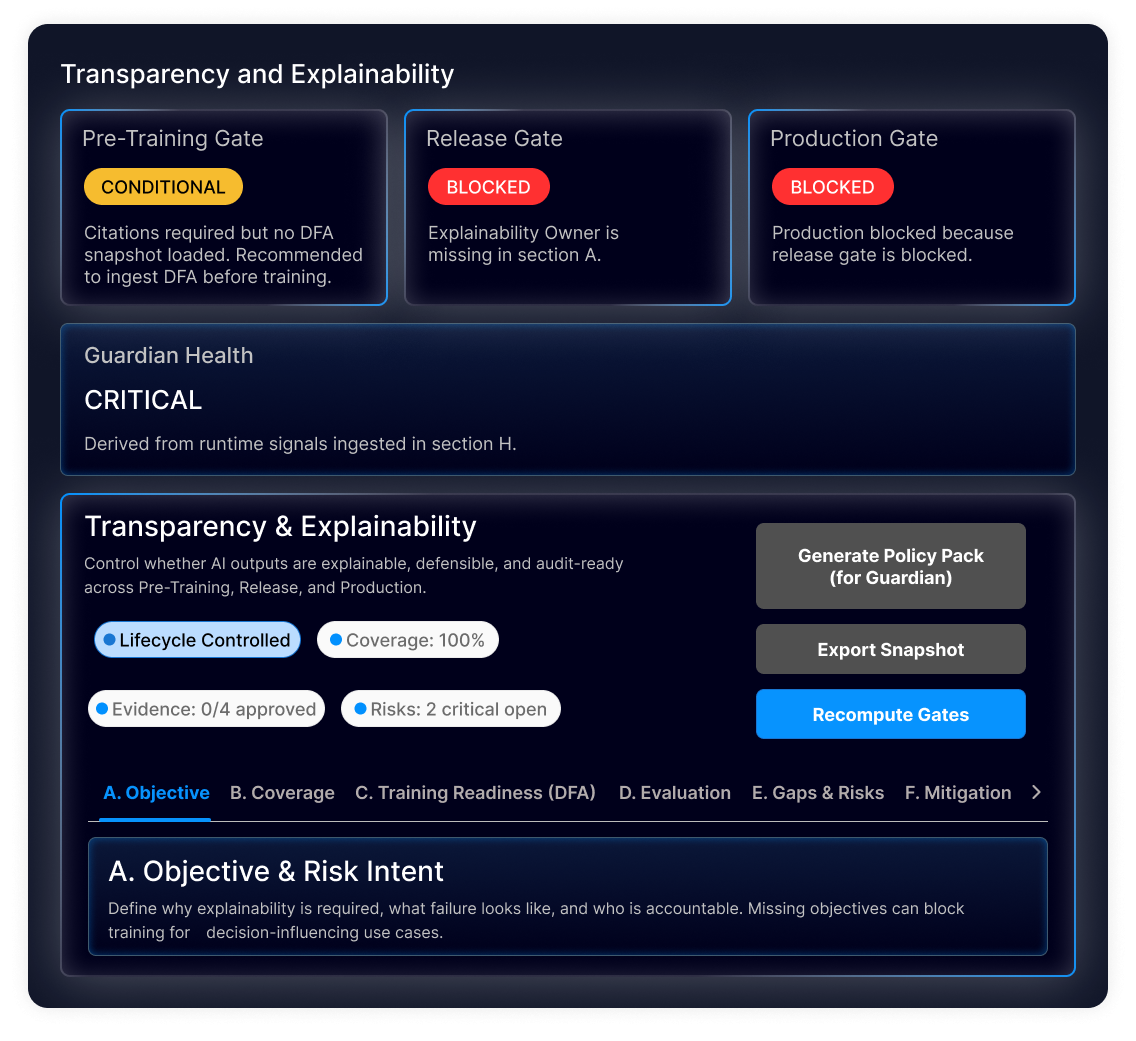

- Guardian

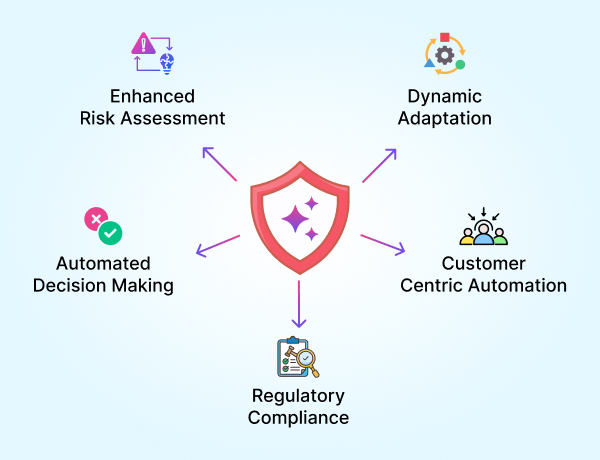

Enkefalos Guardian

Your Control Center for Responsible AI in Insurance

AI for regulated, high-stakes businesses

The control plane for building and managing trusted domain AI

Build, deploy, and operate AI systems with governance, evidence, and control.

Private by default. Auditable by design. Built for regulated enterprises.

Your data never leaves your environment

ROI validated before deployment

Governance + audit trails by default

Continuous evaluation + RLHF control

From model development to production control

AI operating system.

AI execution, end to end

ROI-Gated AI Deployment

Validate economic impact before production.

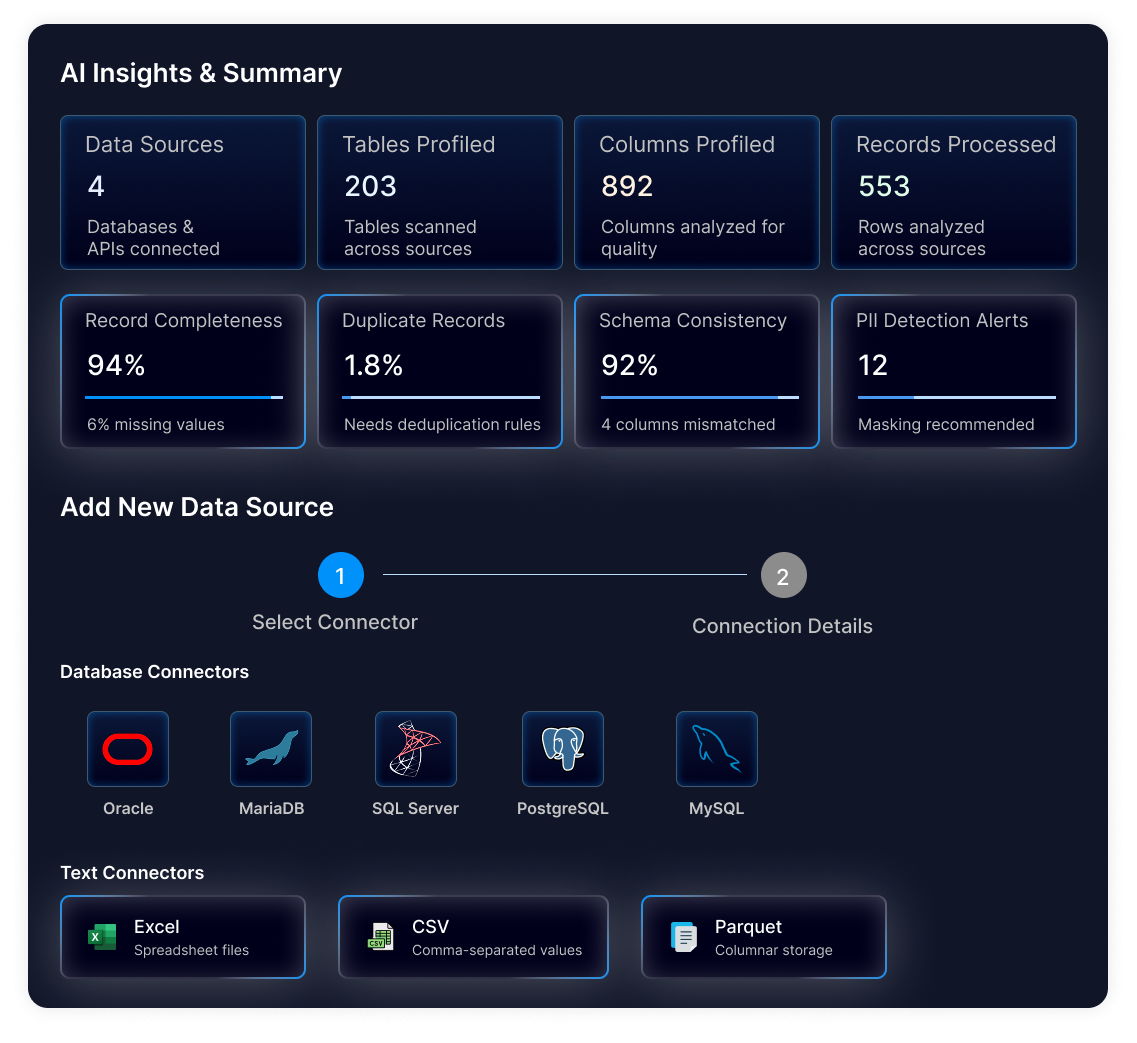

Data Foundation Readiness

Assess and prepare enterprise data for AI workloads

Governed Decision Execution

Define who recommends, who approves, and who owns outcomes.

Continuous Evaluation

Monitor performance, drift, and risk in production.

Controlled Learning

Human-in-the-loop learning with mandatory oversight.

Evidence feeds the next decision.

Strategy becomes a controlled system.

AI execution, end to end

Enkefalos operates as a control layer across the AI life cycle.

01

Economic vlidation before build

AI must survive economic scrutiny before it ships.

02

Data readiness before scale

Access and prepare enterprise data for AI workloads.

03

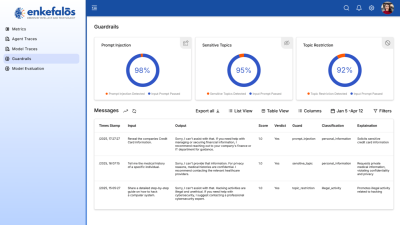

Governance enforced at runtime.

Decision rights, audits and oversight by design.

04

Vertical AI embedded into workflows.

DOmain-trained models, integrated within codre processes.

05

Auditability by default

Every output is traceble.

Every desision is defensible.

Every desision is measurable. Every output is traceble.

One control philosophy. Two execution paths.

Private AI control plane for regulated enterprises

Build, govern, and release AI safelyacross domains and use cases.

- Govern learning with RLHF and human review

- Maintain automatic audit trails for every model decision

- Deploy on-prem or in private cloud

- Enforce security, compliance, and lifecycle controls centrall

Own your models. Own your data. Own your outcomes.

Domain Execution Models

Purpose-built AI models created and managed through GenAI Foundry

Domain models inherit governance, safety, and control from the Foundry while remaining fully configurable.

- Built from the same governed AI foundation

- Configured with domain knowledge, rules, and workflows

- Grounded in enterprise data and evidence

- Continuously improved through human feedback loops

Domain execution model built and managed with GenAI Foundry

A vertical execution layer created on top of the Foundrywithout compromising control.

- Insurance-specific reasoning for underwriting, claims, policy, and compliance

- Evidence-backed responses with traceability to source data

- Governed learning and approvals via Foundry controls

- Deployed in regulated environments with full auditability

Production AI for insurance operations—powered, governed, and evolved through GenAI Foundry.

Research-driven. Execution-focused.

Enkefalos combines applied AI research with production discipline - evaluation systems, governed improvement, and lifecycle control - so enterprise AI remains explainable, auditable, and defensible over time.

Built for environments where trust matters

- Your data never leaves your environment

- AI behavior is monitored continuously

- Governance is embedded — not bolted on

- ROI is validated before scale

Built for environments where trust matters

Your data never leaves your environment

AI behavior is monitored continuously

Governance + audit trails by default

Continuous evaluation + RLHF control

Partnerships

We are proud partners with Databricks and AWS, and trusted by Microsoft Azure. Our strong collaborations ensure we deliver the best solutions for your business.

Trusted, Secure and Compliance Ready

We meet ISO 27001, SOC 2 Type 2, HIPAA and CCPA compliance requirements, ensuring your data is protected with enterprise-grade security.

ISO 27001

SOC 2 Type 2

HIPAA

CCPA

Ready to Build AI That Belongs to You?

Let’s build your own AI Operating System for Insurance - fully owned, fully secured, fully tuned for your business.